Bank of England base rate

How to use our base rate change calculator. The global financial crisis causes the UK interest rate to drop to a low of 025.

If you have a problem or question relating to the database please contact the DSD EditorReference Id 16308164031.

. The Bank of England has raised interest rates by 075 percentage points to 3 per cent in its most forceful act to tame inflation for 30 years but signalled that borrowing costs would not rise in. The Base Rate is the interest rate set by the Bank of England and is also known as the official Bank Rate. 47 rows The base rate is the Bank of Englands official borrowing rate.

The current Bank of England base rate is three per cent. Overall seven policymakers voted on. The base rate has changed to 225 Theres no need to call us well write to you if there are any changes to your payments as a result of the base rate increase on 22nd.

At its meeting ending on 21 September 2022 the MPC voted to increase Bank Rate by 05 percentage points to 225. What we are doing about the rising. The Bank of England base rate is currently at a high of 3.

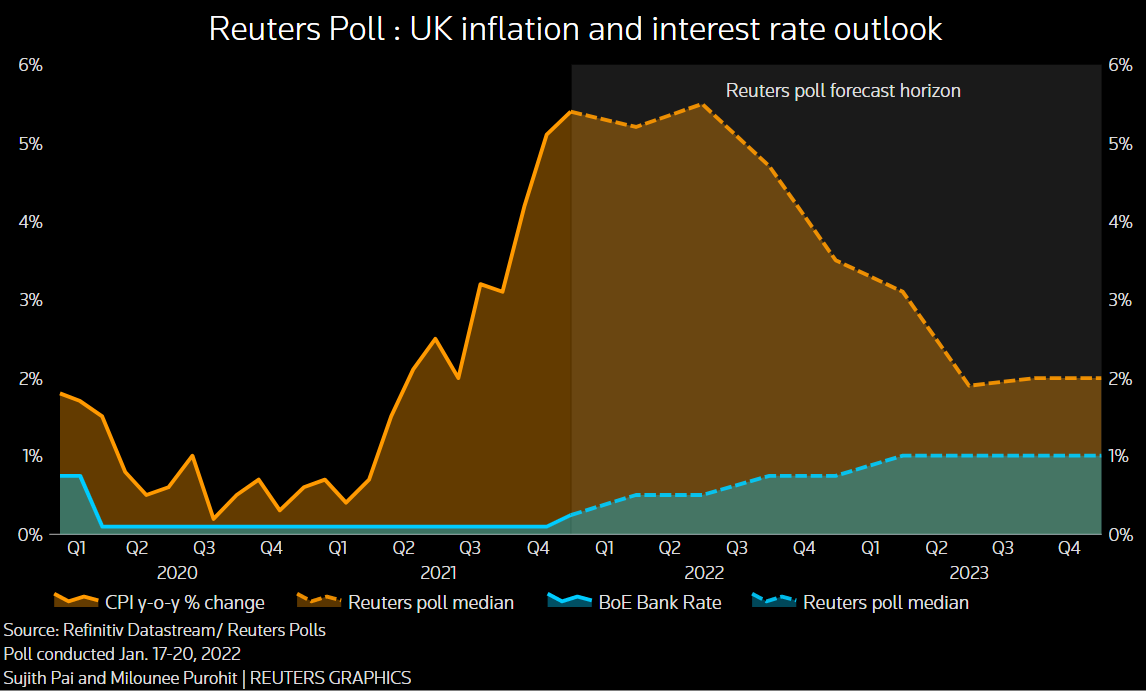

Bank Rate was previously seen topping out at 300 but that has now moved to 425 to be reached early next year and the highest forecast was for it to reach 575. The base rate was increased from 225 to 3 on November 2022. It could rise to 075 in 2022 bringing it back to pre pandemic levels.

The current base rate is 225. The Bank of England raised interest rates by three quarters of a percentage point on Thursday the biggest hike in 33 years as it tries to contain soaring. Its the rate the Bank of England charges other banks and other lenders when they borrow money and its currently 225.

The current base rate. Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability. The Bank of England base rate is currently.

The base rate is effectively increased over the next few years to combat high inflation. The base rate influences the interest rates that many lenders charge. MAJOR banks have cut mortgage bills for some customers - despite the Bank of England hiking interest rates.

Monetary Policy Summary and minutes of the Monetary Policy Committee meeting Read more about Bank Rate increased to 3 -. However todays decision by the Bank of England was not a unanimous one with some members of the MPC disagreeing with the move. This rate is used by the central bank to charge other banks and lenders.

Please enter a search term. The base rate is expected to finish the year above 3 and could peak at close to 41 in June 2023 based on interest-rate derivatives linked to the meeting dates of Threadneedle. Interest rates set by the Bank of England are unlikely to rise above 5 as markets previously expected a senior official has suggested saying the hit to the economy from such a.

Five members voted to raise Bank Rate by 05 percentage. The base rate was previously reduced to 01. Bank Rate increased to 3 - November 2022.

It is currently 05. While thats higher than it has been since the 2008 financial crisis its still considered on the low side historically keeping mortgage interest rates. The bank rate was raised in November 2021 to 025.

To use our calculator youll need to enter your remaining balance the number of years and months left on your mortgage and your current. Continue reading to find out more about how this could affect you. London CNN Business.

This Bank of England interest rate decision was announced after the Monetary Policy Committee meeting on 3 November. The central bank raised its base rate of interest yesterday by 075. The Bank of England raised interest rates by the most since 1989 on Thursday but warned investors that the risk of Britains longest recession in at least a century means.

The Bank of England has increased the base rate from 225 to 3 the largest single rise since 1989.

Bank Of England Announces Biggest Interest Rate Hike In 27 Years

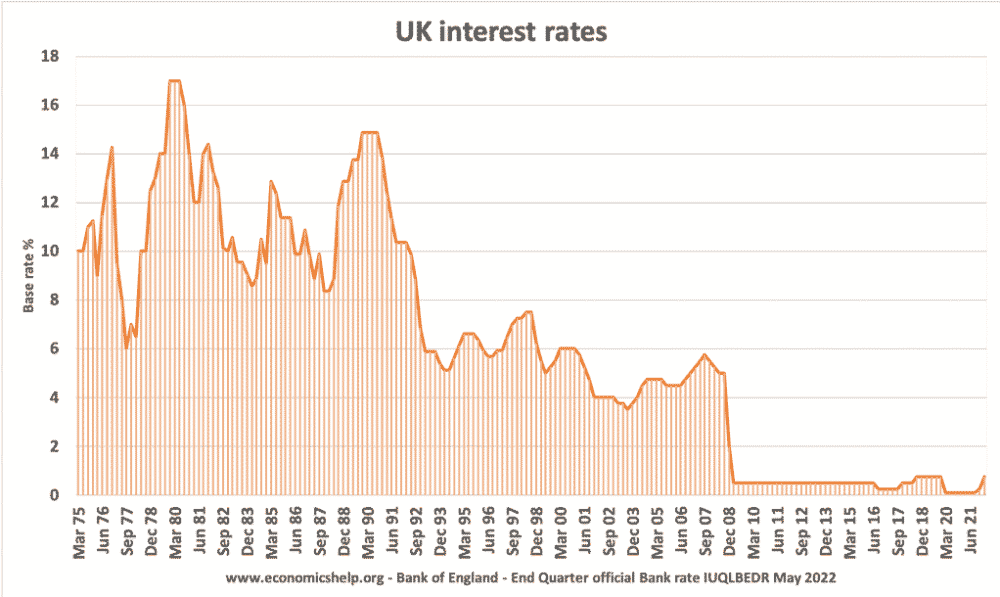

Historical Interest Rates Uk Economics Help

Bank Of England Set For Biggest Interest Rate Rise In 27 Years

Bank Of England To Raise Rates Again In February As Inflation Surges Reuters

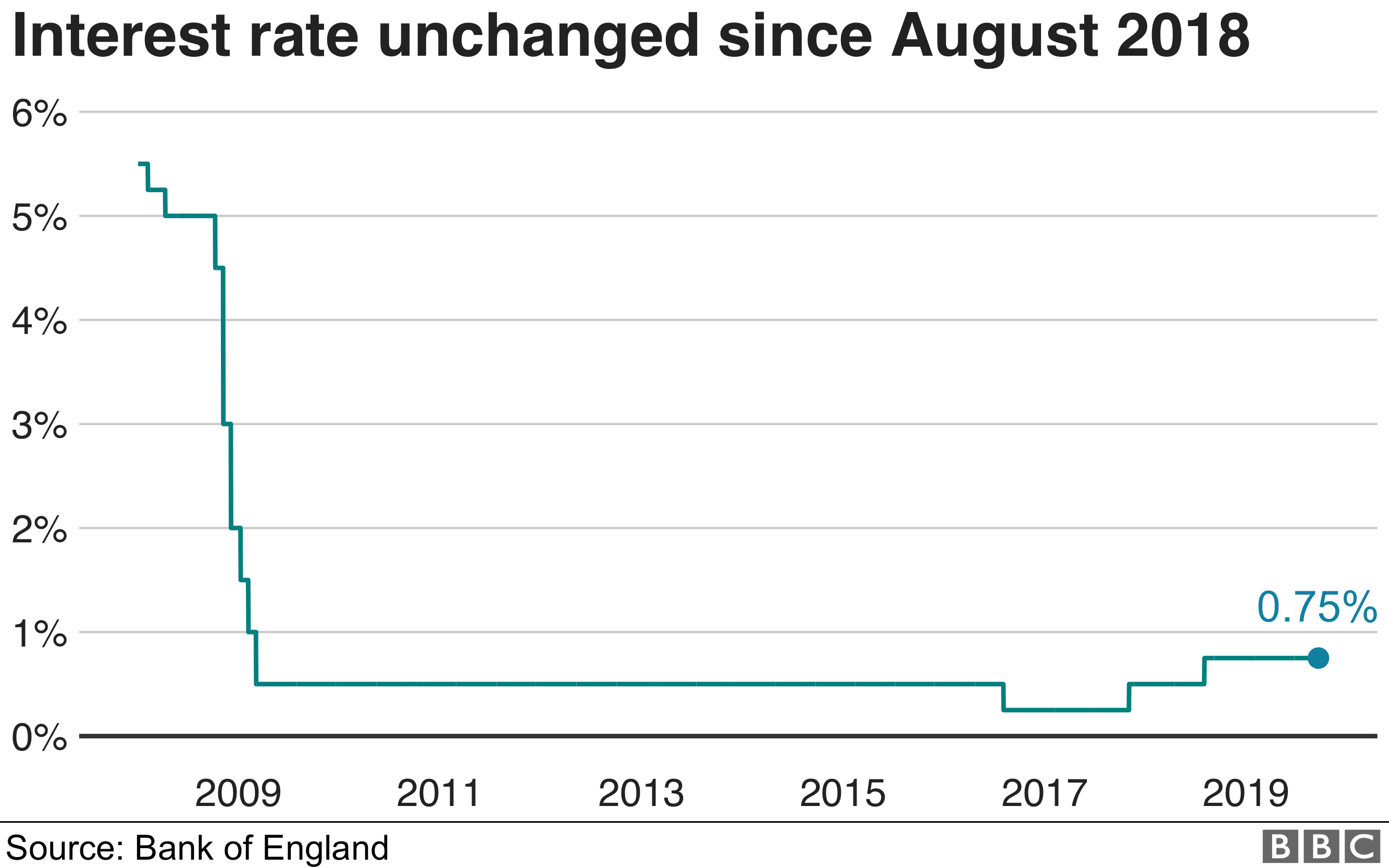

Bank Of England Forecasts Low Interest Rates For Longer Bbc News

Bank Of England Says Inflation Will Hit 11 After Raising Interest Rates To 13 Year High As It Happened Business The Guardian

Bank Of England Set For Biggest Rate Hike In 33 Years But Economists Expect Dovish Tilt

The Bank Of England Must Weather High Inflation And Meddling Politicians The Economist

Bank Of England Expected To Raise Interest Rate To 13 Year High To Tackle Inflation Business News Sky News

Interest Rates Held At 0 01 But Bank Of England Warns They Could Go Negative How Would It Affect Your Finances The Sun

Bank Of England Preview Edging Towards A 2022 Rate Hike Article Ing Think

What Are Interest Rates Bank Of England

Christopher Vecchio Blog Central Bank Watch Boe Ecb Interest Rate Expectations Update Talkmarkets

Negative Rates Explained Should Uk Investors Prepare Schroders Global Schroders